2025-26 Cost Recovery Implementation Statement (CRIS)

The Cost Recovery Implementation Statement (CRIS) provides information on how the Australian Industrial Chemicals Introduction Scheme (AICIS) implements cost-recovery charging for its regulatory activities.

Download PDF

1. Introduction

1.1 Purpose of the CRIS

The Cost Recovery Implementation Statement (CRIS) provides information on how the Australian Industrial Chemicals Introduction Scheme (AICIS) implements cost-recovery charging for its regulatory activities. This document demonstrates how AICIS’s regulatory charges have been developed in compliance with the Australian Government Charging Framework (AGCF) and Australian Government Cost Recovery Policy (AGCRP). It also clearly outlines the regulatory charges to be applied from 1 September 2025. It reports actual financial and non-financial performance information for regulatory charging and contains financial and demand forecasts for Financial Years (FY) 2025-26 through to 2028-29.

1.2 AICIS’s role and functions

The Industrial Chemicals Act 2019 (IC Act) establishes AICIS as the regulatory Scheme for the importation and manufacture (introduction) of industrial chemicals in Australia. The Scheme is administered by the Executive Director supported by staff within the Australian Government Department of Health, Disability and Ageing. The Department of Climate Change, Energy, the Environment and Water (DCCEEW) completes the environmental component of AICIS assessments and evaluations under a service-level agreement with AICIS.

The information from AICIS assessments and evaluations is made available to state, territory and other Commonwealth agencies to assist in regulating the use, release and disposal of industrial chemicals. The information also supports chemicals management legislation designed to protect human health and the environment.

Key AICIS regulatory activities are summarised below and described in more detail in Section 3:

- scientific assessment and evaluation of industrial chemicals

- maintain the Australian Inventory of Industrial Chemicals

- provide information and recommendations about the risks and uses of industrial chemicals

- fit-for-purpose regulation

- meet obligations under international agreements for import and export of restricted Industrial chemicals

- enhance scientific, data and chemical intelligence expertise and harmonise international best practice

- monitor compliance and investigate breaches of the IC Act

- registration of industrial chemical introducers

- corporate and regulatory support activities.

1.3 AICIS’s purpose

The main purpose of AICIS is to help protect human health and the environment by assessing the introduction and use of industrial chemicals and providing information and recommendations about managing any identified risks. AICIS is designed to make regulatory effort proportionate to the risks posed by industrial chemical introductions. It also promotes innovation and encourages the introduction of lower-risk chemicals.

1.4 How fees and charges recover costs

The full cost of administering the Scheme is recovered from the regulated industry through fees for services and registration charges (levies). Fees for services apply to a service provided to a specific introducer. The registration charge relates to the regulation of the market as a whole and funds regulatory activities that are not attributable to a service provided to a specific introducer.

AICIS fees for services apply to activities such as pre-market assessments and authorisations of unlisted chemicals, listing chemicals on the Inventory or amending Inventory listings, applications to protect confidential business information and authorisations to import/export severely restricted industrial chemicals subject to international agreements (e.g. Rotterdam Convention). All registrants pay an annual application fee to be listed (or re-listed) on the Register of Industrial Chemical Introducers.

Consistent with being a post-market scheme, most of AICIS’s operational costs are funded through the annual registration charge levied on importers and manufacturers (introducers) of relevant industrial chemicals above a certain threshold. Where an introducer imports and/or manufactures relevant industrial chemicals above this threshold ($49,999), an annual registration charge is payable. The applicable levy rate depends on the introduction value of relevant industrial chemicals introduced in the previous financial year and is calculated based on a statutory formula.

Activities supported by the annual registration charge include:

- post-market evaluation of industrial chemicals

- post-market compliance monitoring and enforcement

- providing information and recommendations about managing risks from the introduction and use of industrial chemicals

- maintaining best practice and fit-for-purpose regulation

- promoting the international harmonisation of regulatory controls or standards for industrial chemicals

- maintaining the Inventory

- enhancing scientific, data and chemical intelligence expertise

- collection and publication of information and statistics

- corporate activities to support the efficient and effective operation of the Scheme.

1.5 AICIS’s regulated entities and appropriateness of cost recovery

It is Government policy that the full cost of AICIS regulatory activities be recovered from regulated entities (introducers of industrial chemicals). Refer to Section 2 for details on the policy authority that supports AICIS charging arrangements and Section 3 on the design of those charges.

Consistent with the Government’s policy position, full cost recovery is appropriate because:

- introducers create the demand for AICIS’s regulatory activities, driven by the introduction of chemicals into Australia creating a risk ‘to the ongoing protection of human and/or environmental health

- in response, AICIS undertakes a number of specific and technical regulatory activities in accordance with the Industrial Chemicals Act 2019 (IC Act)

- equity is maintained through industry charges, with specific industry groups incurring varying fees and charges based on their impost on AICIS resources.

AICIS’s regulated entities include manufacturers and importers of industrial chemicals. These range from large national and international businesses; research companies and universities; and medium to small businesses to individuals and small-scale soap makers. AICIS's regulated entities seeking to import, export or manufacture chemicals with an industrial use pay an annual fee to register their business on the Register of Industrial Chemical Introducers, plus a levy (for total introductions above $49,999) that varies according to the value of industrial chemicals introduced.

Chemical introductions where the beneficiary is clearly identifiable attract fees. These include:

- assessed introductions

- commercial evaluation authorisations

- early listing of chemicals on the inventory

- protection of confidential business information.

Regulated entities introducing under ‘Listed introductions’ utilise the Australian Inventory of Industrial Chemicals, and regulatory costs cannot be attributed to a specific introducer. Introductions under exempted and reported categories, although directly attributable to specific introducers, do not currently attract a fee, specifically to promote innovation and encourage the introduction of lower-risk chemicals. They are subject to screening by AICIS staff to identify introductions that may require further analysis and possible compliance monitoring and case management. Activities related to compliance monitoring, case management and functions that support the Scheme are funded through levies.

2. Policy and statutory authority to charge (cost recover)

2.1 Government policy approval to charge for this

regulatory activity

The policy authority to fully recover the cost of activities of industrial chemical regulation was provided for in the 1994-95 Budget under the measure “Implementing full cost recovery in 1996–97 for National Industrial Chemicals Notification and Assessment Scheme”.

Reforms to the regulation of industrial chemicals were implemented through the establishment of AICIS, which replaced the National Industrial Chemicals Notification and Assessment Scheme (NICNAS) on 1 July 2020.

The establishment of AICIS maintained the Government’s policy position that the full cost of regulatory activities be recovered through fees and charges paid by regulated entities (introducers of industrial chemicals). Full cost recovery continues to be applied and is considered appropriate because introducers continue to create the need for industrial chemicals in the marketplace to be regulated.

Refer to Section 3 for further details.

2.2 Statutory authority to charge

Fees for services are specified in Ministerial rules made under the Industrial Chemicals Act 2019.

Charges are specified in regulations made under the:

- Industrial Chemicals Charges (Customs) Act 2019

- Industrial Chemicals Charges (Excise) Act 2019

- Industrial Chemicals Charges (General) Act 2019

The 3 charges Acts provide the statutory basis for the registration charge to be based on annual introduction value. As AICIS regulates both the importation and manufacture of industrial chemicals, the registration charge could be legally characterised not only as a tax but also as a duty of customs or a duty of excise requiring 3 separate Acts.

3. Charging (cost recovery) model

3.1 Outputs and business processes of regulatory activities

To aid in the protection of human health and the environment, AICIS undertakes regulatory and support activities across several areas. In accordance with the AGCRP, activities are underpinned by their regulatory outputs, which are achieved by undertaking respective business processes. The breakdown of an activity into outputs and processes is demonstrated in Table 1 below and are representative, not exhaustive.

Table 1 – Activity, outputs and process concept

| Activity | Outputs – aligns to charge point | Processes |

|---|---|---|

| Activities are made up of outputs, which together form regulatory and supporting activities to control or influence behaviour, manage risk and/or protect the community and the environment. | A Regulatory output is the aggregated total of its associated business processes, which are transformed into cost recovered outputs. | Business processes encompass a series of tasks that are performed by people or systems to produce an output. |

The key activities undertaken by AICIS includes:

- scientific assessment and evaluation of industrial chemicals, including chemical identification and scientific screening

- maintaining the Australian Inventory of Industrial Chemicals

- providing information and recommendations about the risks and uses of industrial chemicals

- best practice, fit-for-purpose regulation

- meeting obligations under international agreements for import and export of restricted industrial chemicals

- enhancing scientific, data and chemical intelligence expertise and harmonising international best practice

- monitoring compliance with and investigating breaches of the IC Act

- corporate and regulatory support activities.

The breakdown of the above activities into outputs, processes and charging mechanisms is demonstrated in Tables 2 – 10 below.

Table 2 – Scientific assessment and evaluation of industrial chemicals

| Activity | Outputs | Key Business Processes | Charging mechanism |

|---|---|---|---|

AICIS undertakes pre- and post-market assessments/evaluations to identify potential risks to human health and/or the environment that may be associated with the introduction (import or manufacture) and use of industrial chemical(s) in Australia. AICIS issues assessment certificates and commercial evaluation authorisations for the introduction of unlisted industrial chemicals into Australia following a pre-market assessment. AICIS makes recommendations to relevant risk management agencies, where required, to ensure appropriate controls are in place. | Assessment certificate & assessment statement | Consider application by:

| Fee for service |

| Commercial evaluation authorisation | Consider application by:

| Fee for service | |

| Evaluation Statement | Initiate evaluation by:

| Levy |

Table 3 – Maintain the Australian Inventory of Industrial Chemicals

| Activity | Outputs | Key Business Processes | Charging mechanism |

|---|---|---|---|

AICIS maintains the Australian Inventory of Industrial Chemicals (Inventory) database of chemicals available for industrial use in Australia, containing chemical identity details, regulatory obligations or conditions relating to the importation and manufacture of industrial chemicals. Chemicals listed on the Inventory are authorised for introduction, so long as those introductions meet the relevant associated regulatory obligations. | Listing on Inventory before 5 Years from certificate issue date | Consider application by:

| Fee for service |

| Listing on Inventory at 5 years from the certificate issue date | List chemical | Levy | |

| Variation of Inventory listing | Consider application by:

Decision on application:

The terms of an Inventory listing can be varied or a listing be removed following the evaluation process outlined in Table 2. | Fee for service

Levy | |

| Continued protection of confidential information (CBI) | Provide written notice of review of protection:

Consider application by:

Decision on application:

| Fee for service | |

| Confidential Inventory searches | Complete confidential search of the Inventory and response to requestor. | Levy | |

| Applying to be a confidence holder in relation to confidential listings (transitional chemicals) | Consider application by:

Decision on application:

| Fee for service |

Table 4 – Provide information and recommendations about the risks and uses of industrial chemicals

| Activity | Outputs | Key Business Processes | Charging mechanism |

|---|---|---|---|

| Assessment/evaluation statements are published on the AICIS website for use by all stakeholders, including other Australian Government and state and territory regulatory agencies such as public health, worker health and safety, environmental, transport and consumer product safety agencies. | Industrial chemical notices | Publish notices on the AICIS website with potential terms and reasons for:

| Levy |

| Risk Management Recommendations Register | Publish statements and provide timely access to the status of risk-management recommendations for assessed and evaluated industrial chemicals, that are referred to relevant prescribed bodies. | Levy |

Table 5 – Fit for purpose regulation

| Activity | Outputs | Key Business Processes | Charging mechanism |

|---|---|---|---|

| The Industrial Chemicals (General) Rules 2020 and the Industrial Chemicals Categorisation Guidelines are regularly reviewed and updated to ensure AICIS regulation remains contemporary and fit for purpose, within existing policy settings. | Set and maintain the Industrial Chemicals Rules, Categorisation Guidelines, and guidance |

| Levy |

Table 6 – Meet obligations under international agreements for import and export of restricted Industrial chemicals

| Activity | Outputs | Key Business Processes | Charging mechanism |

|---|---|---|---|

| AICIS can approve, restrict or prohibit the introductions or export of industrial chemicals listed in international conventions and assists Australia to meet its obligations by undertaking compliance monitoring and enforcement activities relating to industrial chemicals under the Rotterdam and Minamata Conventions. | Approved/Not Approved import or export of restricted industrial chemicals subject to international agreements | Process applications, decide and provide response to:

| Fee for service |

Compliance monitoring of restricted industrial chemicals under the Minamata or Rotterdam Convention agreements including:

| Levy |

Table 7 – Enhance scientific, data and chemical intelligence expertise and harmonise international best practice

| Activity | Outputs | Key Business Processes | Charging mechanism |

|---|---|---|---|

AICIS scientific assessments incorporate the best available scientific evidence, use modern risk assessment tools and approaches, use data driven decisions, risks and means for managing risks are clearly described. AICIS works with other countries to harmonise and adopt (where applicable in the Australian context) international standards and risk assessments methods. | Chemical intelligence | Develop data driven decision making and chemical data intelligence with computational science, for risk proportionate chemical introduction. | Levy |

| Strengthened international arrangements and active participation in international activities | Harmonise, develop and adopt international standards and methods through international activities, horizon scanning and scientific development. | Levy | |

| High quality scientific risk assessments | Implementation of the AICIS regulatory science strategy | Levy |

Table 8 – Compliance monitoring and investigate breaches of the IC Act

| Activity | Outputs | Key Business Processes | Charging mechanism |

|---|---|---|---|

| AICIS undertakes activities such as compliance monitoring of introducers and introductions of industrial chemicals under the IC Act, managing compliance cases, liaising with other Australian enforcement agencies. | Introducers are registered |

| Levy |

| Reported introductions are authorised |

| Levy | |

| Exempted introductions are authorised |

| Levy | |

| Listed introductions are authorised |

| Levy | |

| Compliance of annual declarations for all introduction categories |

| Levy |

Table 9 – Registration of industrial chemical introducers

| Activity | Outputs | Key Business Processes | Charging mechanism |

|---|---|---|---|

| Registration of industrial chemical introducers enables AICIS to identify entities introducing industrial chemicals and supports effective regulatory oversight. | Register of Industrial Chemical Introducers | See Table 15 for detailed process | Fee for service |

Table 10 – Corporate and regulatory support activities

| Activity | Outputs | Key Business Processes | Charging mechanism |

|---|---|---|---|

| Corporate and regulatory support activities support the efficient and effective administration of the Scheme. | Industrial Chemicals Special Account |

| Levy |

| AICIS website and Communication |

| Levy | |

| Stakeholder Engagement Committee |

| Levy | |

| Business planning and Regulatory reporting |

| Levy | |

| AICIS Business Services (online portal) | Supporting users of the AICIS Business Services portal to transact online with the Scheme. | Levy |

3.2 Costs of the regulatory activity

3.2.1 Cost drivers

The key cost drivers that inform the estimate for AICIS’s cost base are:

- the effort required to deliver each business process and activity,

- the resource cost to conduct each business process and activity, and

- the annual volume of each activity performed.

On this basis AICIS’s cost base can be summarised as, total effort (hours) to undertake required business processes and activities, multiplied by the applicable hourly rate, multiplied by the annual volumes of business processes completed. The methodology and approach for estimating each driver is detailed below. This calculation is demonstrated in Cost Calculation Methodology section 3.2.3.

AICIS remains committed to delivering legislative and regulatory functions efficiently and effectively at the minimum efficient cost. AICIS has broadly identified the efficient cost across organisational key business processes, outputs and activities through the ongoing completion of effort and time capture activities. Effort capture data is reviewed on an ongoing basis, to ensure that any shifts in effort requirements are understood and business practices may be reviewed to ensure continued service delivery.

Effort

When AICIS was established in 2020-21, regulatory charging was based on historical effort data from comparable NICNAS activities (where available) in combination with estimates for new activities. Through ongoing monitoring of effort and data analysis, fundamental differences between the two Schemes have been identified that limit the utility of historical data as a wholly reliable proxy of true effort and associated costs for all regulatory activities.

To refine effort and cost estimates, historical data have been adjusted or replaced with actual AICIS data collected through detailed effort and time capture activities as it becomes available. AICIS continues to undertake in-depth time capture across all functions to validate the accuracy of estimated business process / activity effort contributing to charging outcomes.

Resources

AICIS employs a diverse resourcing mix to efficiently carry out its business activities, drawing on the technical expertise and experience necessary for effective delivery. AICIS’s primary resourcing utilises ongoing Australian Public Service (APS) employees responsible for delivering most of its business outcomes. In some instances, modest supplier resources such as consultants and contractors are engaged to complement AICIS’s internal capabilities. This includes costs associated with the environmental component of risk assessments undertaken by DCCEEW which are included in the cost base.

This flexible arrangement allows AICIS to adapt to changing demands and scale its resources accordingly while delivering activities at the minimum viable cost, while ensuring service delivery standards. By leveraging external support as necessary, AICIS achieves cost-effective delivery without compromising regulatory outcomes.

AICIS’s forward year cost base is indexed to recognise inflationary factors and ensure that budgets and forecasts are reflective of likely future costs. The applied indexation rate is weighted to reflect the relevant proportion of employee costs, recognised through the Wage Price Index (WPI), and supplier costs, recognised through the Consumer Price Index (CPI) or equivalent rate.

Volumes

AICIS forecasts annual volumes of each activity by applying prior year actual volumes as a baseline, then conducting data analysis and modelling to estimate volumes based on market trends. Outcomes of the technical analysis are overlayed with business knowledge to quantify the forecast volumes for each charge point. The depth of technical analysis continues to increase as the Scheme matures, and greater annual sample sizes are available. The regulated entities continue to gain a stronger understanding of their regulatory obligations and relationship with AICIS.

In addition to the above, further analysis was undertaken for levy forecast volumes to estimate what proportion of registrants would ‘upgrade’ into a higher registrant tier due to an increase in chemical introduction value.

3.2.2 Cost base

The cost base in its entirety comprises the estimated costs of efficiently and effectively delivering AICIS’s regulatory functions. Costs such as those incurred for policy functions by areas within the Department of Health, Disability and Ageing, are specifically excluded from the cost base, as these are funded by Government or other mechanisms.

Table 11 – AICIS estimated cost base, 2025-26 to 2028-29 ($’000)

| Expenses | 2025-26 | 2026-27 | 2027-28 | 2028-29 |

|---|---|---|---|---|

| Employee and contractor expenditure | 15,277 | 15,791 | 16,322 | 16,872 |

| Non-employee expenses | - | - | - | - |

| Supplier (including DCCEEW) | 7,628 | 7,817 | 8,011 | 8,211 |

| Depreciation1 | - | - | - | - |

| Total2 | 22,905 | 23,608 | 24,334 | 25,083 |

The activities undertaken to regulate the introduction of industrial chemicals under the Industrial Chemicals Act 2019 can be aggregated and grouped into two broad categories: regulatory outputs and support activities.

Regulatory outputs are activities provided to an individual or organisation or those provided to a broader group of individuals and organisations. In 2025-26, AICIS will continue to recover the costs of undertaking regulatory activities using a combination of fees and charges (levies) based on the demand for a government activity or intervention. Outputs can comprise both direct and indirect costs, where direct costs can easily be traced to an output with a high degree of accuracy. Indirect costs are those that cannot be easily linked to an output and are usually related to overhead costs such as support staff salaries and technical support or property and are therefore apportioned across outputs using appropriate cost drivers.

Depreciation expenses are based on AICIS’s current asset profile and may vary if new assets are acquired or existing ones are fully depreciated. In the 2024–25 CRIS, Table 11 – AICIS Estimated Cost Base included projected depreciation expenses for IT systems classified as depreciable assets. However, from 2025–26 onwards, depreciation will only be reported for IT products that meet the capitalisation criteria under AASB 116 Property, Plant and Equipment and AASB 138 Intangible Assets. Following a 2023–24 review by the Department of Health and Aged Care, AICIS’s current IT build has been reclassified as a Software as a Service (SaaS) arrangement. Under this model, costs will be recognised as expenses when incurred, rather than being capitalised and depreciated over time.

Table 12 outlines regulatory outputs and support activities classified as direct costs and support activities that are classified as indirect costs.

Table 12 – Examples of AICIS outputs as direct and indirect costs

| Regulatory outputs: Direct costs (fees for services) | Regulatory outputs: Direct costs (cost recovery levies) | Support activities: Indirect costs |

|---|---|---|

| Registration of introducers | Compliance monitoring and enforcement | Management of the Special Account |

| Assessment Certificate applications | Post-market evaluation of chemicals | Enhancing Scientific Expertise |

Commercial Evaluation Authorisation applications | Pre-introduction reports and post-introduction declarations | Corporate governance |

| Inventory early listing and variation applications | Maintenance of Inventory | Fit for purpose Legislation |

| Confidential business information (CBI) protection applications | Stakeholder engagement/education | Website and IT |

| Applications for import / export of restricted industrial chemicals into or out of Australia | Enquiries and complaints management | Regulatory and business reporting |

AICIS uses an activity-based costing (ABC) methodology to allocate all direct and indirect costs incurred by AICIS to each activity and subsequently each charge point.

The cost base comprises:

- Direct costs such as labour costs and some supplier costs that can be directly linked to a specific activity.

- Indirect costs, including corporate costs such as finance, human resources and property, which will be driven to activities using relevant activity drivers that will reflect the link between the cost of the services and the likely amount of those services absorbed to the amount allocated.

- Capital costs including depreciation and capital investment where appropriate.

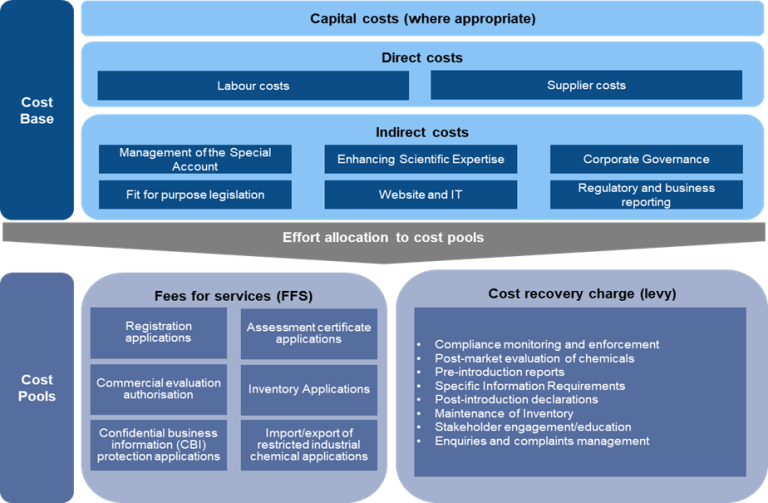

Figure 1 (below) presents a schematic of the activity based cost model. An example of how a fee for service item is calculated is included at 3.2.3 Example of cost calculation methodology.

Figure 1 – Activity Based Cost Model

Table 13 shows the estimated total cost of regulatory activities inclusive of support function costs using the ABC methodology.

Table 13- Estimated cost by regulatory output for 2025-26 ($’000)

| Regulatory outputs | Fee or Levy | Direct Costs | Indirect Costs | Total Costs3 |

|---|---|---|---|---|

| Registration applications | Fees for services | 307 | 285 | 592 |

| Assessment certificate applications | Fees for services | 460 | 281 | 741 |

| Commercial evaluation authorisation | Fees for services | 10 | 6 | 15 |

| Inventory applications | Fees for services | 57 | 53 | 110 |

| Confidential business information (CBI) protection applications | Fees for services | 43 | 34 | 77 |

| Import / export of restricted industrial chemicals into or out of Australia applications | Fees for services | 16 | 13 | 30 |

| Compliance monitoring and enforcement | Levy | 3,106 | 2,351 | 5,457 |

| Post-market evaluation of chemicals | Levy | 8,221 | 4,735 | 12,956 |

| Pre-introduction reports | Levy | 121 | 98 | 219 |

| Specific Information Requirements | Levy | 302 | 245 | 547 |

| Post-introduction declarations | Levy | 179 | 145 | 324 |

| Maintenance of Inventory | Levy | 662 | 536 | 1,198 |

| Stakeholder engagement/education | Levy | 149 | 120 | 269 |

| Enquiries and complaints management | Levy | 186 | 150 | 336 |

| Total4 | 13,820 | 9,053 | 22,873 | |

Figures include direct and indirect costs. Figures may not total due to rounding.

3.2.3 Example of cost calculation methodology

The charge for any specific regulatory output should recover the full efficient cost of delivering that specific service. This section outlines the methodology used to cost one such regulatory output as an example to demonstrate the approach for determining the cost of the regulatory output: “Registration of industrial chemical introducers”, broken down into business processes and activities.

Table 14 – Total cost calculation of ‘Registration of industrial chemical introducers to inform legal obligations’

| Activity | Regulatory output | Effort required (hrs) | Average cost per hour ($) | Cost per delivery of regulatory output ($) | Volume delivered annually | Total cost of regulatory output ($) |

|---|---|---|---|---|---|---|

| Registration of industrial chemical introducers enables AICIS to identify entities introducing industrial chemicals and supports effective regulatory oversight | Register of Industrial Chemical Introducers | 0.56 | 146.36 | 81.80 | 7,243 | 592,457.97 |

Table 14 breaks down the component tasks of the business process undertaken to achieve that regulatory output. It shows the role that performs each task, the effort required to complete each task, and the cost of each task.

Table 15 – Detailed cost calculation breakdown of the business processes for ‘Registration of industrial chemical introducers to inform legal obligations’

| Regulatory output | Business processes | Role performing task | Hours of effort | Cost per role ($) |

|---|---|---|---|---|

| Register of Industrial Chemical Introducers |

| Registration Support Officer | 0.36 | 52.16 |

| Registration Officer | 0.10 | 14.09 | |

| Assistant Director of Corporate | 0.10 | 14.12 | |

| Director of Corporate | 0.01 | 1.43 | |

| Total hours of effort per application | 0.56 | 81.80 | ||

Table 16 breaks down the component tasks for each of the five activities performed by the Registration Support Officer that contributes to the ‘Maintaining register of industrial chemical introducers’ business process. The table shows the hours of effort required to complete the tasks, the cost per hour of the role, which produces the cost of the task.

Table 16 – Total cost calculation of ‘Registration Support Officer’

| Business processes | Role performing task | Role cost per hour ($) | Hours of effort per task | Cost per task ($) [Role cost per hour] x [Hours of effort per task] |

|---|---|---|---|---|

| Registration Support Officer | 146.36 | 0.36 | 52.16 |

Table 17 breaks down the cost per hour of the role Registration Support Officer to show the proportion of costs that are direct and indirect.

Table 17 – Cost calculation breakdown of Registration Support Officer by direct and indirect cost

| Role | Direct cost per hour ($) | Indirect cost per hour ($) | Total cost per hour ($) |

|---|---|---|---|

| Registration Support Officer | 75.87 | 70.49 | 146.36 |

3.3 Aligning regulatory effort to regulatory charge

3.3.1 Aligning fees for services to regulatory effort

AICIS’s approach to activity-based costing seeks to confirm the level of effort expended against a regulatory activity is proportionate to the risk and ensure outputs are delivered at the minimum efficient costs. As detailed in Table 13, certificate applications and registration applications are the two largest regulatory outputs recovered through cost recovery fees, followed by Inventory Listing applications and CEA applications.

Registration applications

The Industrial Chemicals Act 2019 imposes an annual registration fee and levy (where relevant) on all introducers of industrial chemicals. The annual fee recovers the registration application costs of registering individuals and maintaining the Register of Industrial Chemical Introducers, which are activities provided to the individual or organisation by the Corporate Services function of AICIS. These activities include the management of registration enquiries, provision of Business Services portal helpdesk and management of registration refunds.

A high level of regulatory effort is required to meet the volume of registration applications. Further information for the cost calculation methodology for registration applications, including the detailed breakdown of the associated activities is provided in section 3.2.3 Example of cost calculation methodology.

Assessment certificate applications, CEA applications and Inventory Listing applications

AICIS’s assessment function is responsible for conducting pre-market assessments for a range of applications including Assessment certificates, CEA and Inventory Listing/confidential business information applications.

The cost of the regulatory output for assessment certificate applications is driven by regulatory effort required to ensure that:

- the chemical is accurately identified,

- the introduction is correctly categorised,

- sufficient data and studies are available and included for assessment,

- exposure is appropriately determined,

- hazards are assessed using various scientific methods, including Quantitative Structure-Activity Relationship (QSAR) predictions, Quantitative Risk Assessment (QRA), Adverse Outcome Pathways (AOPs) and read-across approaches,

- the risks of the introduction are thoroughly assessed,

- recommendations are made to risk management bodies for identified risks

3.3.2 Aligning levies to regulatory effort

The AGCRP states that the levy payable should bear a reasonable relationship to the driver of regulatory activities in a manner that approximates the level of resources required to provide the activity across the regulated group.

As demonstrated in Table 13 above, the evaluations program and compliance program are the two biggest regulatory outputs whose costs are recovered through the cost recovery levy, as these two programs are responsible for compliance monitoring and enforcement, post-market evaluation of chemicals, pre-introduction reports (PIRs) and post-introduction declarations (PIDs). The information provided below demonstrates the link between risk and regulatory effort for these key regulatory outputs. This reflects the post-market nature of the Scheme’s design.

Post-market evaluation of chemicals

AICIS evaluates risks from industrial chemicals already authorised for introduction and use in Australia, predominantly chemicals already listed on the Inventory that do not have a current risk assessment. AICIS can also evaluate chemicals that are introduced under an assessment certificate or the reported or exempted categories, in response to emerging concerns and/or new information. In consultation with community and industry stakeholders, AICIS has committed to identify and prioritise for evaluation industrial chemicals currently in use that do not have a current risk assessment. (see Table 2 for further detail).

Available data suggests that as annual introduction value increases, businesses generally introduce:

- larger numbers of different chemicals, and in larger volumes, which increase exposure and the likelihood of greater risks to humans and the environment,

- more complex chemicals, which require greater regulatory effort to characterise risk and correspondingly more complex risk management considerations.

- higher proportion of PIDs and PIRs driving greater effort in post-market regulatory activities to confirm these introductions have been correctly categorised.

Compliance monitoring and enforcement

AICIS uses a risk-based approach to promote awareness of obligations, check record-keeping requirements and identify and manage cases of non-compliance. By monitoring activities in response to emerging risks, AICIS focuses on introducers at higher risk of non-compliance and introductions that pose a higher risk to human health and the environment. It is not possible to ascertain every introducer’s degree of compliance in advance of undertaking compliance monitoring or to base the funding model on the degree of risk of the chemicals introduced.

When monitoring compliance, if there are no other risk indicators – for example, among a group of industrial chemical introducers with no prior compliance history – regulatory effort is prioritised using introduction value as a proxy for exposure (and therefore risk). This is because, in a group of introducers introducing similar products, those introducing a greater introduction value will most likely be importing/manufacturing a greater volume, which will result in greater risk and therefore, proportionately, greater regulatory effort.

Use of introduction value as a proxy for regulatory effort

To develop a charging regime that aligns with the AGCRP, the most appropriate method for funding regulatory activities through the registration levy must be determined. The central principle of the AGCRP is that charging be aligned with the drivers of regulatory effort.

The risk posed by a chemical is a function of hazard and exposure; exposure is a function of use pattern and volume. As the hazard of a chemical cannot be changed, risk management involves minimising exposure, where required. The risk-based approach for funding regulatory activities that are not services provided to identifiable recipients is also primarily based on levels of exposure of humans and the environment.

It is a long established international practice for the annual volume of introduced chemicals to function as a proxy for exposure, as a larger volume generally translates to more workers exposed, or more consumer products on the shelves (public exposure), or more of the chemical flowing down drains and into waterways (environmental exposure).

AICIS does not hold nor have legal authority to obtain data on the volumes of all industrial chemicals introduced into Australia. Obtaining such data would involve additional regulatory burden on industry, which is contrary to the policy aims of the recent reforms.

In contrast, the value of introductions is readily available to Government, at the least burden to industry. As established above, there is correlation between introduction value and introduction volume including an increase in the number and complexity of chemicals introduced, which is indicative of risk that requires proportionate regulatory effort. It is on this basis that introduction value has been the legislative basis on which the levy was established under the former NICNAS for over 25 years and continues to apply under AICIS.

At this stage, based on the data collected to date, introduction value is considered the most appropriate proxy for regulatory effort. Through the effort data capture process undertaken by AICIS and DCCEEW, the data set will be more robust and analysis of a more robust data set will determine whether alternative charging approaches are more suitable to better align costs with charges. As part of the annual CRIS, the effort data has been reviewed confirming that the levy tier structure detailed in the 2024-25 CRIS remains appropriate.

Any further changes will be included in the 2026-27 CRIS. Stakeholder consultation will occur before any additional charging approaches are implemented.

3.4 Design of the regulatory charge

3.4.1 Design of fees for services

AICIS charges fees for services where a direct relationship exists between the regulatory activity and the individual or organisation requesting that specific activity. All regulated entities are charged the same fee for the same activity. Under these circumstances, the activities performed, and their associated costs, are driven by a specific need and demand created by the applicant (an application).

Each fee for service item can be broken down into a number of functional processes as set out by the IC Act. For example, certificate applications:

- Certificate (s32) consider application

- Certificate (s33) request further information

- Certificate (s34) consult with prescribed bodies

- Certificate (s35) consult with Gene Technology Regulator

- Certificate (s36) Submissions of draft statement

- Certificate (s37) Issue certificate and statement

3.4.2 Design of levies

When the cost of the AICIS activity can be reasonably attributed to a broader group of organisations (or individuals) rather than a single entity, the activity will continue to be funded through a cost recovery levy. In these instances, the level of demand for Government activity or intervention is collectively driven by the industry as a whole rather than a single entity within it. The registration level and charge payable is determined for each registrant based on the annual introduction value using prior financial year introductions (as defined in Section 6 of the Industrial Chemicals Charges (General) Regulations 2020, Industrial Chemicals Charges (Customs) Regulations 2020 and Industrial Chemicals Charges (Excise) Regulations 2020).

As part of ongoing commitment to continuous improvement, AICIS refined its approach to cost recovery in the 2024-25 Cost Recovery Implementation Statement (CRIS). This included an adjustment to registration level thresholds to better align charges with the effort required to deliver regulatory activities and consequently, the associated costs.

AICIS will continue to apply its eight-tiered model to determine the annual registration charge, ensuring it is informed based on the effort required for leviable activities. This approach upholds the charging principles set out in the Australian Cost Recovery Policy, ensuring that fees remain efficient, effective and transparent.

An exemption is applied from paying the levy for introduction values less than $50,000 in the previous financial year, with a maximum charge of $35,000 payable by a Level 8 introducer. The full breakdown of the registration level structure and corresponding prices are provided in Table 22.

3.4.3 Changes to regulatory charges

Fees for services

AICIS monitors the Scheme to ensure the ongoing appropriate alignment of fees and charges to relevant costs informed by the best available information at the time. Where there is systemic deviation of cost and revenue, AICIS will seek to realign its charges to maintain a break-even position.

The charging structure for all fees for services will be continued from previous years while further effort data is collected to determine the true and minimum efficient cost of providing each service. As the scheme continues to mature and a greater sample size of fee for service volumes are delivered, it is expected that overall data confidence will increase and charging outcomes will become more robust.

For 2025-26, AICIS will retain the current fees i.e. no changes are being proposed to fees for services.

Levies

Historically, AICIS has observed higher than forecast levy charge revenue contributing to a surplus budget result in prior years resulting from a higher than anticipated number of registrants at the higher registration values, and a higher than anticipated number of upgrades as a result of declarations of introduction values being lower than actual introduction values. In response, AICIS reduced levy price in 2022-23 and 2023-24 by 8% and 11.7%, respectively. In 2024-25, AICIS adjusted the introduction value thresholds within the existing eight-tier registration model broadly informed by the effort required to undertake relevant leviable activities.

The Levy structure and associated charges will be maintained for 2025-26 (see Table 22) informed by the projected volumes and expenses, and regulatory effort required to support leviable activities.

Continuation of lower and upper threshold for calculation of charge payable

The introduction value thresholds for charging the registration levy are aligned with the risk-based approach to determining regulatory effort outlined above. Lower value introducers generally introduce lower volumes of chemicals resulting in lower human and environmental exposures than higher value introducers.

Data from Pre-Introduction Reports (PIR) and Post-Introduction Declarations (PIDs) also indicates that higher value introducers submit more PIRs and PIDs than lower value introducers. This trend is also reflected in data obtained from enquiries where registrants could be identified. However, while regulatory effort increased with higher introduction values, a plateau is reached. Beyond this point, charging a higher registration levy would not be risk-proportionate. This outcome is supported by AICIS regulatory effort capture activities.

Ongoing commitment to appropriate charging arrangements

AICIS will continue to monitor the maturation of the Scheme to a steady state given it is still a maturing Scheme. This will help AICIS to refine effort drivers for both levy funded and fee for service activities and thus ensure that fees and charges reflect the efficient cost of delivering regulatory activities and services. AICIS will also consider how to appropriately address the accumulation of prior year revenue held in the Industrial Chemicals Special Account.

3.4.4 Annual fees and charges for 2025-26

The schedule of fees and charges was developed to align with the AGCRP and to recover the costs of AICIS activities for 2025-26. The fees and charges apply to introducers of industrial chemicals.

The charge points for AICIS can broadly be grouped by relevant activities:

- Registration – levy and fee for service

- Certificates and CEA – fee for service

- Protection of confidential business information – fee for service

- Import and export of certain severely restricted industrial chemicals subject to international agreements – fee for service.

Annual registration

Table 18 – Registration fee 2025-26

| AICIS Fee for service | Fee per application ($) 2025-26 | Forecast volume | Forecast revenue ($) |

|---|---|---|---|

| Application for registration | 80 | 7,243 | 579,440 |

Certificate and authorisation

Table 19 – Certificate and authorisation fees 2025-26

| AICIS Fees for services | Charge per application ($) | Forecast volume | Forecast revenue ($) |

|---|---|---|---|

| Certificate Applications | |||

| Application for a certificate – very low to low risk | 7,670 | 10 | 76,700 |

| Application for a certificate – health focus or environment focus | 24,100 | 13 | 313,300 |

| Application for a certificate – health and environment focus | 36,050 | 10 | 360,500 |

| Application for a certificate - comparable hazard assessment | 18,060 | - | - |

| Consolidated application | 7,235 | - | - |

| Application to vary the terms of an existing Assessment Certificate | 4,885 | 3 | 14,655 |

| Application to add a certificate holder | 1,540 | - | - |

| Application to remove a certificate holder | 830 | - | - |

| Application to add a person covered by a certificate | 1,540 | 3 | 4,620 |

| Application to remove a person covered by a certificate | 830 | - | - |

| Multicomponent Application | 2,735 | - | - |

| Authorisation Applications | |||

| Application for a Commercial Evaluation Authorisation | 6,695 | 2 | 13,390 |

| Application to vary the terms of an authorisation | 2,605 | 1 | 2,605 |

| Application to add an authorisation holder | 1,540 | - | - |

| Application to remove an authorisation holder | 830 | - | - |

| Inventory Applications | |||

| Application for listing on the Inventory before 5 years | 1,540 | 21 | 32,340 |

| Application for variation of listing | 4,885 | 2 | 9,770 |

Protection of confidential business information

Table 20 – Protection of confidential business information 2025-26

| AICIS Fees for services | Charge per application ($) 2025-26 | Forecast volume | Forecast revenue ($) |

|---|---|---|---|

| Application for protection of proper name | 1,785 | 13 | 23,205 |

| Application for protection of end use | 625 | 12 | 7,500 |

| Application for continued protection | 4,710 | 10 | 47,100 |

| Application for protection of confidential business information (CBI) other | 1,190 | - | - |

| Application to be a confidence holder of CBI for a protected inventory listing | 4,230 | - | - |

Import and export of restricted industrial chemicals subject to international agreements

Table 21 – Import and export of restricted industrial chemicals subject to international agreements 2025-26

| AICIS Fees for services | Charge per application ($) 2025-26 | Forecast volume | Forecast revenue ($) |

|---|---|---|---|

| Application for Category A export of restricted industrial chemicals out of Australia, subject to international agreements | 2,470 | 4 | 9,880 |

| Application for Category B export of restricted industrial chemicals out of Australia, subject to international agreements | 4,930 | 4 | 19,720 |

| Application for Category C export of restricted industrial chemicals out of Australia, subject to international agreements | 2,470 | - | - |

| Application for import of restricted industrial chemicals into Australia, subject to international agreements | 4,930 | - | - |

AICIS registration levy

Table 22 –AICIS Registration levy 2025-26

| Registration level (prior year introduction value) | Charge per registration ($) 2025-26 | Forecast volume | Forecast revenue ($) |

|---|---|---|---|

| Registration – level 1 ($1 - $49,999) | Nil | 3,000 | - |

| Level 2 ($50,000 - $99,999) | 65 | 786 | 51,090 |

| Level 3 ($100,000 - $249,999) | 180 | 960 | 172,800 |

| Level 4 ($250,000 - $499,999) | 350 | 750 | 262,500 |

| Level 5 ($500,000 - $2,999,999) | 2,100 | 984 | 2,066,400 |

| Level 6 ($3,000,000 - $4,999,999) | 3,750 | 250 | 937,500 |

| Level 7 ($5,000,000 - $14,999,999) | 24,500 | 231 | 5,659,500 |

| Level 8 ($15,000,000+) | 35,000 | 282 | 9,870,000 |

1 Depreciation expenses are based on the existing asset profile, subject to change if assets are acquired or fully depreciated.

2 The total estimated cost base includes the cost of activities considered non-recoverable under the AGCF. These costs will not be recovered through the proposed fees and charges as indicated in Table 11.

3 Total costs include regulatory activities where forecast volumes equal zero, resulting in nil estimated total costs.

4 Total estimated cost by regulatory output for 2025-26 excludes the FOI/non-cost recoverable amount of approximately $31k

4. Risk assessment

In accordance with AGCRPs, a Charging Risk Assessment has been undertaken that considered the future operating environment, including its:

- complexity: structure, processes and implementation of cost recovery activities

- materiality: financial value of the cost recovery activities

- sensitivity: level of interest from key stakeholders in the cost recovery activities.

The overall cost recovery risk rating for 2025-2026 is determined to be low.

These identified key risks, and their mitigation strategies are documented in Table 23 below.

Table 23 – Risks and risk mitigation strategies

| Risk | Mitigation strategy |

|---|---|

| Assumptions made for the new Scheme are not reflective of actual regulatory effort or cost | Regulatory effort and costs will continue to be monitored. Assumptions informing the cost model will continue to be replaced by contemporary data as collected. AICIS continues to gather and improve the quality of internal effort data to inform future pricing. |

| Under- or over-recovery through levies due to change in introduction value of industrial chemicals per introducer. | Introduction value monitoring will continue considering the pricing of each level and the appropriateness of the level structure through the annual CRIS process. |

| Under-recovery of fee for service activities due to the low number of applications made under the IC Act. This is especially relevant given the post introduction regulatory focus of the scheme | Volumes of applications and associate effort will be monitored, and charges will be reviewed through the annual CRIS process. There are currently no further price revisions due to insufficient data being available to substantiate year on year volume variation. |

| Reserve balance significantly increases or depletes beyond targeted levels | The impact of the charging structure on the reserve balance will continue to be monitored with consideration given to forecast future costs and revenue predictions. |

| Registration level upgrades and downgrades in response to bracket creep cause and under or over recovery of revenue through levies | Trend analysis will continue to monitor the number of registration level adjustments and if deemed necessary, will be built into the future iterations of the model. |

5. Stakeholder engagement

In accordance with the AGCRP, stakeholder consultation is generally undertaken when changes to cost recovery arrangements are proposed. As AICIS fees and levies will remain unchanged for 2025–26, engagement was appropriately limited to industry associations (see section 5.1.1) with broader consultation to occur for any proposed future changes.

5.1 Industry engagement

5.1.1 Industry association engagement for AICIS’s charging arrangements for 2025-26

In December 2024, AICIS met with representatives from Accord Australasia, Chemistry Australia, and the Australian Paint Manufacturers’ Federation to discuss regulatory charging arrangements. During this engagement, Industry was advised that preliminary analysis of current assessment applications indicated greater regulatory effort than initially anticipated. However, due to high variability in application effort data, AICIS will continue collecting data to improve its reliability and better inform future pricing decisions. At the time AICIS foreshadowed potential indexation of fees for services.

In March 2025, AICIS subsequently advised peak industry associations that fees and levies would remain unchanged for 2025–26 (see section 3.4.3).

6. Financial performance

The financial results for 2021-22 through to 2024-25, underlying assumptions for the 2025-26 budget and forward years are set out in Table 24 (below), prepared on an accrual basis.4

Table 24 – AICIS financial performance ($’000)

| 2021-22 actual | 2022-23 actual | 2023-24 actual | 2024-25 actual | 2025-26 Budget | 2026-27 forward estimate | 2027-28 forward estimate | 2028-29 forward estimate | |

|---|---|---|---|---|---|---|---|---|

| Operational Expenses (A) | 19,197 | 21,650 | 24,069 | 28,674 | 22,905 | 23,680 | 24,334 | 25,083 |

| Cost Recovered Revenue – includes fees for services and levies (B) | 24,394 | 24,323 | 23,091 | 21,128 | 20,535 | 21,089 | 21,658 | 22,243 |

| Government appropriation - interest equivalency payment (C)5 | 58 | 34 | 760 | 1,802 | 1,936 | 1,936 | 1,936 | 1,936 |

| Balance = (B+C)-(A) | 5,255 | 2,707 | -219 | -5744 | -434 | -583 | -740 | -904 |

| Cumulative balance | 24,418 | 27,125 | 26,907 | 21,163 | 20,729 | 20,146 | 19,406 | 18,502 |

Revenue from industry fees and charges for 24-25 totalled $21.1 million a decrease of $2.0 million compared to the previous financial year. Total expenses were $28.7million, an increase of $4.6 million from the previous financial year, primarily due to a one-off accounting adjustment following a review of the department's accounting treatment and classification of capital and operating IT expense. AICIS net result for 2024-25 is a deficit of $5.7 million which has been factored into the overall departmental result.

6.1 Financial Estimates

Material variance commentary: The financial estimates are based on predicted levels of fee for service applications and the number of expected registrants at each level. The estimates also include a substantial increase to appropriation funding in the form of an interest equivalency payment from interest earned on funds held in the Industrial Chemicals Special Account. Revenue forecast for 2025-26 are subject to fluctuations in:

- numbers of fees for services applications

- number of companies per level listed on the Register of Industrial Chemical Introducers

The annual rolling CRIS and future pricing reviews will ensure transparency and ongoing accuracy of revenue and expenditure and detect any upward or downward variations.

Balance Management Strategy: A reserve is used as a risk mitigation measure to allow established charging arrangements to balance and lessen the impact of variable demand on the ongoing delivery of regulatory activities. The AICIS Reserve is fully committed to the following three components, which are maintained to facilitate business continuity requirements, to help fund the ongoing resourcing requirements of AICIS and to allow the Scheme to operate in a sustainable manner:

- Capital investment (41%): funds appropriated to AICIS by Government to support future IT capital projects and/or replacement of the AICIS IT System

- Three months operating reserves (31%)

- Employee entitlements (28%): Consistent with best practice, the reserve retains employee entitlements such as leave provisions.

AICIS remains committed to its defined Balance Management Strategy which is applied as a risk mitigation measure to manage the impact of variable demand on the ongoing delivery of regulatory activities while minimising any revenue over and above its cost base. Adjustments to charging have been demonstrated over consecutive years through price reductions across the levy charge (2022-23: 8% and 2023-24: 11.7%) and a charge in thresholds creating the 8 tier levels determined by total chemical introduction value in 2024-25 (allowing over 95% of registrants to keep or reduce their levy charge).

For 2025-26, although AICIS expects an inflationary impact on its cost base and a small deficit for 2025-26, a net balanced budget is expected due to revenue anticipated from prior year registration level upgrades notified by registered introducers.

Existing reserve balances will continue to be maintained for their defined purposes enabling AICIS to operate in a sustainable manner including future capital investments, employee entitlements and a 3-month operating reserve. Any supplementary balances accumulated (typically through increased program demand) will be actively monitored, with any impact on pricing outcomes to be communicated through future CRIS publications.

6.2 Financial outcomes

The financial results for the 2021-22, 2022-23, 2023-24 and 2024-25 years are shown in Table 25 (below).

Table 25 – Financial performance ($'000)

| Financial item | 2021-22 | 2022-23 | 2023-24 | 2024-25 |

|---|---|---|---|---|

| Estimates | ||||

| Revenue = W | 23,898 | 22,016 | 20,880 | 20,759 |

| Government appropriation - interest equivalency payment = X | 58 | 34 | 753 | 1,802 |

| Expenses = Y | 24,153 | 22,488 | 21,628 | 22,135 |

| Balance = (W+X) – Y | -197 | -438 | 5 | 426 |

| Actuals |

|

|

|

|

| Revenue = W | 24,394 | 24,323 | 23,091 | 21,128 |

| Government appropriation - interest equivalency payment = X | 58 | 34 | 760 | 1,802 |

| Expenses = Y | 19,197 | 21,650 | 24,069 | 28,674 |

| Balance = (W+X) – Y | 5,255 | 2,707 | -219 | -5,744 |

The costs of AICIS’s activities are recovered from industry except for appropriation funding in the form of an interest equivalency payment from interest earned on funds held in the Industrial Chemicals Special Account.

AICIS maintains a percentage of its reserves (as appropriated by government) to fund future IT capital projects and/or replacement of the AICIS IT system. The Government expects AICIS to manage within its cost recovery resources and therefore investment in new or replacement IT assets must come from the responsible management of cash reserves.

4 Figures reported in the Portfolio Budget Statements may differ as they are reported on a cash basis in accordance with the Public Governance, Performance and Accountability (Financial Reporting) Rule 2015.

5 IEP for the Forward Estimates is dependent on interest rates and cash balance in each year and hence AICIS has used the 2024-25 IEP.

7. Non-financial performance

AICIS has reported its non-financial performance for 2024-25 against criteria included in the 2024-25 Health Portfolio Budget Statements in the Department of Health Annual Report, including a performance report from the Executive Director as required under section 146 of the IC Act (Appendix 4: Report on the operation of the Australian Industrial Chemicals Introduction Scheme for 2024-25, page 330-350).

In accordance with the Public Governance, Performance and Accountability Act 2013, the Department of Health, Disability and Ageing's Corporate Plan sets out the performance measures that our Scheme uses to determine whether it is achieving its purpose. AICIS’s measure is aligned to the outcomes, program and key activity presented in our Portfolio Budget Statements.

AICIS ensured assessment quality was maintained through internal peer review processes and seeking feedback from applicants, introducers and other stakeholders prior to finalising each report. Publication of completed assessments and evaluations on the Australian Industrial Chemicals Introduction Scheme website assists Commonwealth, state, and territory governments to implement risk management controls, and facilitates the safe use of chemicals by workers and the public.

Table 26 – Non-financial performance

Output description | 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 | |

|---|---|---|---|---|---|---|

| Proportion of Industrial chemical risk assessments completed within statutory timeframes | Actuals | 96.8% | 100% | 100% | 100% | TBC |

| Estimated | greater than or equal to 95% | greater than or equal to 95% | greater than or equal to 95% | greater than or equal to 95% | greater than or equal to 95% | |

| Registration Applications | Actuals | 7,713 | 7,323 | 7,341 | 7,381 | TBC |

| Estimated | 7,153 | 7,818 | 7,326 | 7,197 | 7,243 | |

| Certificate Applications | Actuals | 7 | 18 | 55 | 19 | TBC |

| Estimated | 127 | 73 | 63 | 60 | 42 | |

| Authorisation Applications | Actuals | 1 | 7 | 17 | 4 | TBC |

| Estimated | 17 | 9 | 6 | 17 | 3 | |

| Inventory Listing Applications | Actuals | 7 | 10 | 39 | 7 | TBC |

| Estimated | 69 | 21 | 4 | 19 | 23 | |

| Confidential Business information (CBI) protection Applications | Actuals | 22 | 23 | 53 | 19 | TBC |

| Estimated | 136 | 38 | 24 | 43 | 35 | |

| Import/export of industrial chemicals into or out of Australia Applications | Actuals | 25 | 7 | 11 | 26 | TBC |

| Estimated | 20 | 5 | 0 | 0 | 8 | |

8. Key forward dates and events

The key forward dates are documented in Table 27

Table 27 – Key forward dates and events

| Key forward events schedule | Next scheduled update |

|---|---|

| Update CRIS for 2026-27 | July 2026 |

9. CRIS approval and change register

The history of changes made to the CRIS and approvals are documented in Table 28.

Table 28 – CRIS approval and change register

| Date of change | CRIS change | Approver | Basis for change |

|---|---|---|---|

| 26/06/2020 | Certification of the CRIS | Acting Secretary, Department of Health | New cost recovered activity |

| 29/06/2020 | Approval of the CRIS | Responsible Minister | New cost recovered activity |

| 30/06/2020 | Agreement to CRIS release | Minister for Finance | High-risk rating for the activity |

| 9/06/2021 | Certification of the CRIS | Secretary, Department of Health and Aged Care | New cost recovered activity |

| 23/06/2021 | Approval of the CRIS | Minister for Regional Health, Regional Communications and Local Government | New cost recovered activity |

| 30/06/2021 | Agreement to CRIS release | Minister for Finance | High-risk rating for the activity |

| 1/12/2021 | Update on 2020-21 financial performance | AICIS Executive Director | Reporting on financial performance |

| 1/08/2022 | Certification of the CRIS | Secretary, Department of Health and Aged Care | Reduced registration charge amounts |

| 2/08/2022 | Approval of the CRIS | Assistant Minister for Health and Aged Care | Reduced registration charge amounts |

| 30/11/2022 | Update on 2021-22 financial performance | AICIS Executive Director | Reporting on financial performance |

| 24/07/2023 | Certification of the CRIS | Secretary, Department of Health and Aged Care | Reduced registration charge amounts |

| 1/08/2023 | Approval of the CRIS | Assistant Minister for Health and Aged Care | Reduced registration charge amounts |

| 30/11/2023 | Updated on 2022-23 financial performance | AICIS Executive Director | Reporting on financial performance |

| 11/06/2024 | Certification of the CRIS | Secretary, Department of Health and Aged Care | Indexed fees for service, and revised registration level thresholds charge amounts |

| 24/06/2024 | Approval of the CRIS | Assistant Minister for Health and Aged Care | Indexed fees for service, and revised registration level thresholds and charge amounts |

| 26/11/2024 | Update on 2023-24 financial performance | AICIS Executive Director | Reporting on financial performance |

| 17/07/2025 | Approval of the CRIS | AICIS Executive Director | No change to fees and levies |

| 28/11/2025 | Update on 2024-25 financial performance | AICIS Executive Director | Reporting on financial and non-financial performance |